As part of our recent webinar, AI in M&A: What’s Working, What’s Next, we polled participants to get a pulse on how deal professionals are currently using AI, and where they see the greatest opportunities ahead. The responses offer a revealing snapshot of an industry in transition: full of interest, but still early in execution.

Current reality: limited systematic AI use

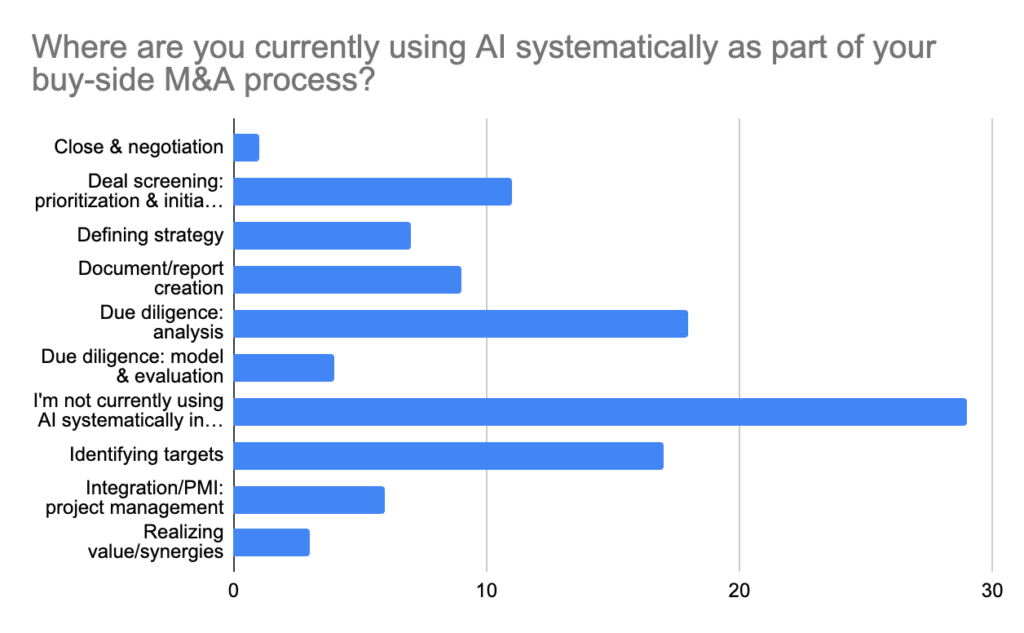

Across the buy-side M&A practitioners in attendance, 46% said they are not yet using AI systematically in their deal process.

Among the rest, the top current use cases are:

- Due diligence (analysis)

- Identifying targets

- Deal screening & prioritization

- Document/report creation

Clearly, many teams are still in experimentation mode—and focused on applying AI in labor-intensive tasks that benefit from automation or summarization.

Looking ahead: where AI will expand in M&A

Opportunities on the buy-side:

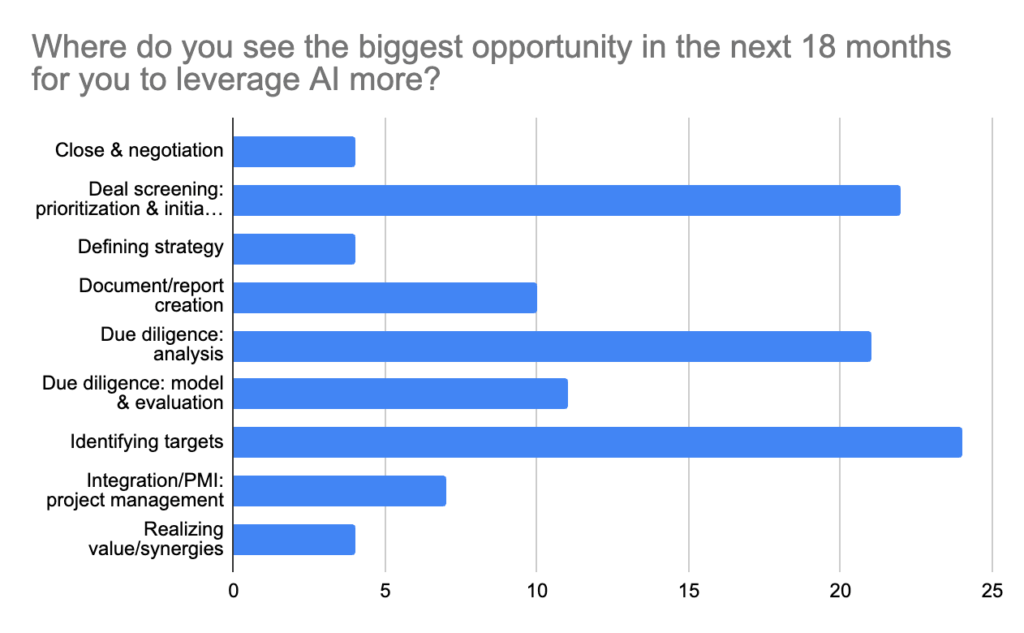

When asked where they see the biggest AI opportunity over the next 18 months:

- Due diligence (a combined 32 responses across analysis, modeling, and evaluation) and identifying targets (24 responses) topped the list.

- Deal screening (22 responses) followed close behind.

This signals a strong push toward streamlined due diligence analysis and smarter sourcing and faster screening — particularly for programmatic M&A teams.

Opportunities on the sell-side:

From the sell-side participants, the top identified future opportunities for AI usage were:

- Market preparation

- Approach & modeling

- Due diligence

- Bid process automation

The sell-side clearly wants to streamline the go-to-market and transaction readiness phases — and increasingly sees AI as a way to reduce time-to-deal and improve outcomes.

Takeaway: AI’s M&A inflection point is now

From sourcing to screening, diligence to documentation, M&A teams are starting to identify repeatable areas where AI can save time, reduce risk, and improve decision-making. While adoption is still early, the signal is strong: AI is set to play a central role in both buy-side and sell-side M&A — especially in tasks that demand speed, scale, and synthesis.

Interested in seeing how M&A teams are already putting AI to work?

Watch the full webinar on demand