Choosing the right M&A software can make or break the success of your corporate development strategy. But with the M&A software landscape still relatively new—and evolving fast—it’s easy to feel uncertain about what questions to ask or which features really matter.

We spoke with several of our customers to understand what criteria truly made the difference in selecting the right platform for their M&A pipeline, due diligence, and post-merger integration efforts. Here’s what we learned.

1. Flexibility and End-to-End Workflow Support

Key question: Will it fit our process and scale with us as we grow?

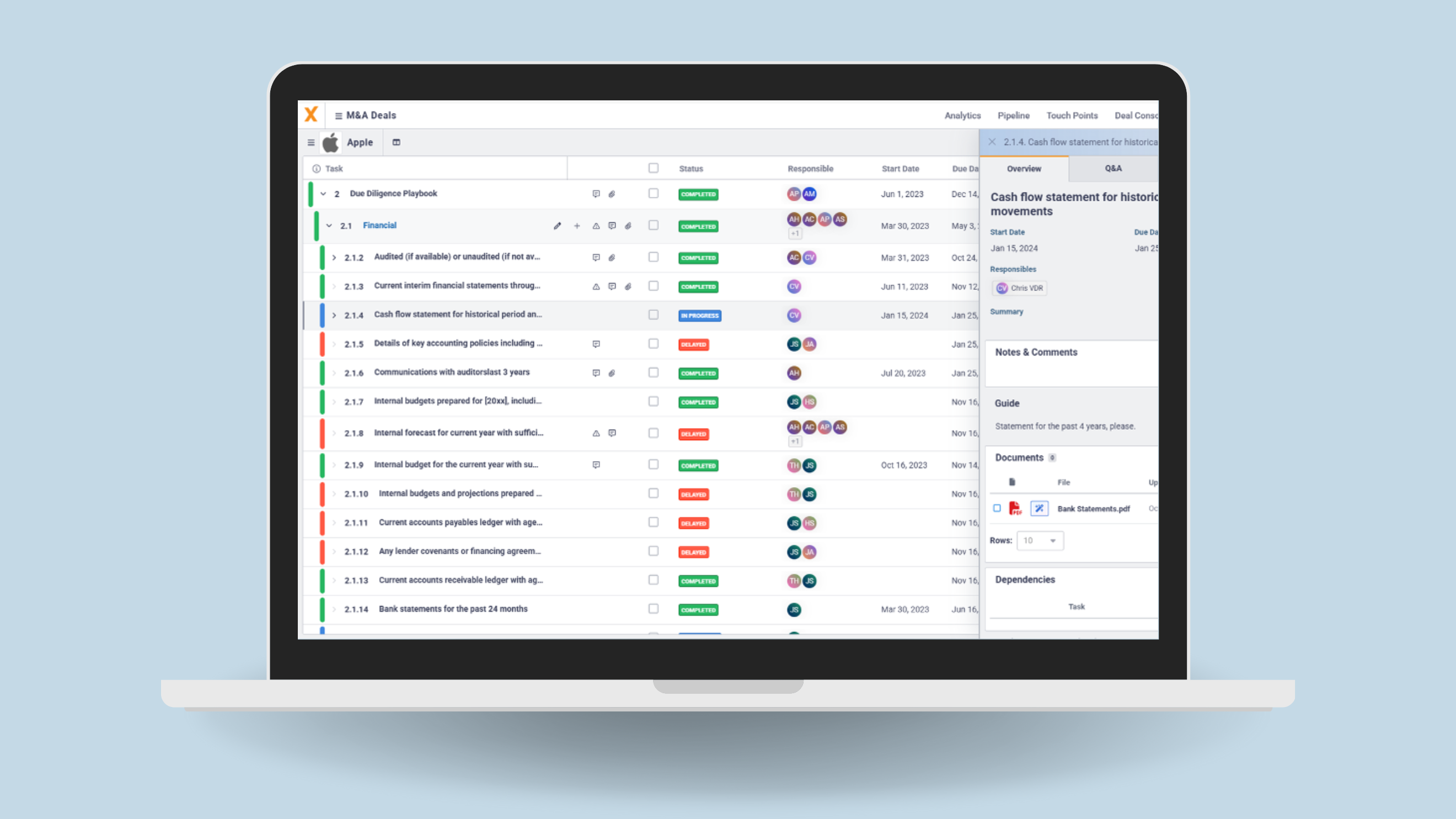

Your M&A process is unique—so your software needs to be adaptable. Look for a solution that’s not only flexible but also supports your entire deal lifecycle, from target identification to integration. Many tools only handle part of the process, which forces teams to patch together point solutions and manually transfer data—slowing everything down.

Why Midaxo?

Designed and tested for use in M&A, teams worldwide trust Midaxo to streamline M&A pipeline management, due diligence, and post-merger integration. Midaxo offers a complete, end-to-end solution designed for the needs of modern M&A teams.

2. Built-In Expertise & Ecosystem Support

Key question: Can we leverage best practices to improve our M&A process?

If your team is still refining your M&A playbook—or if you’re onboarding new team members—having access to proven frameworks can be a game-changer. Look for platforms that offer built-in playbooks, templates, and dashboards developed by experts and top consulting firms.

Why Midaxo?

Midaxo customers benefit from 100+ ready-to-use M&A playbooks, dashboards, and best-practice templates—all built in collaboration with Big 4 firms and experienced acquirers.

3. Ease of Use, User Adoption & Support

Key question: Will my team actually use it?

Even the most powerful M&A software is useless if no one uses it. Choose a platform that’s intuitive, easy to onboard, and backed by strong customer support. Look for options that offer self-service resources and responsive help when your team needs it.

Why Midaxo?

Our platform is praised for being user-friendly and fast to adopt. Midaxo’s Customer Success team offers tailored onboarding and ongoing support, with quick action.

“There is no tool that compares to Midaxo in terms of ease of use and user-friendly interface”

-Sergio E. Letelier (VP & Assoc. General Counsel, HPE)

4. Enterprise-Grade Security & User Controls

Key question: Is our sensitive data protected—and can we securely collaborate with external partners?

Your organization’s M&A deals involve highly sensitive information. Choose a platform with robust data security, audit trails, role-based permissions, and secure ways to bring in outside collaborators without compromising your internal systems.

Why Midaxo?

Midaxo is ISO 27001 certified, with regular third-party audits and penetration testing. You can safely involve external users without giving them access to your internal network—and easily export your data at any time.

5. Proven Track Record & Customer Success

Key question: Do real M&A teams trust this solution—and see measurable ROI?

Before investing in any platform, look at the customer base. Are other corporate development teams seeing success? Are there testimonials or case studies that align with your goals?

Why Midaxo?

Midaxo has customer case studies and testimonials available, sharing benefits like 50% less time in due diligence, more visibility, and 40% shorter post-merger integrations. We have co-presented with customers about results at many top industry events, including with Daimler at the MergerMarket Germany Forum and with Hewlett Packard Enterprise at CLOC.

6. Vendor Stability & Product Innovation

Key question: Will this platform grow with us—or become obsolete?

You want to invest in M&A software backed by a stable, innovative company. Look for strong financial backing, active development, and a clear roadmap for future improvements.

Why Midaxo?

Midaxo works with 300+ happy customers and 6+ consulting firms, including more than 75 companies on the Fortune 2000 list. We’re backed by leading investors and are proud of our large, nimble development team continuously innovating. From new AI-powered features to smarter reporting, Midaxo is always evolving to meet the needs of high-performing M&A teams.

Final Thoughts

The right M&A software can significantly reduce risk, accelerate deal timelines, and help your team operate more strategically. By evaluating solutions across these six key criteria—flexibility, best practices, usability, security, trust, and innovation—you can feel confident you’re choosing a partner that will grow with your M&A program.

Curious how Midaxo stacks up?

Explore Midaxo’s customer stories →

Schedule a personalized demo →

An earlier version of this article was published in 2019. Read that version here.