Lean M&A teams, bigger impact

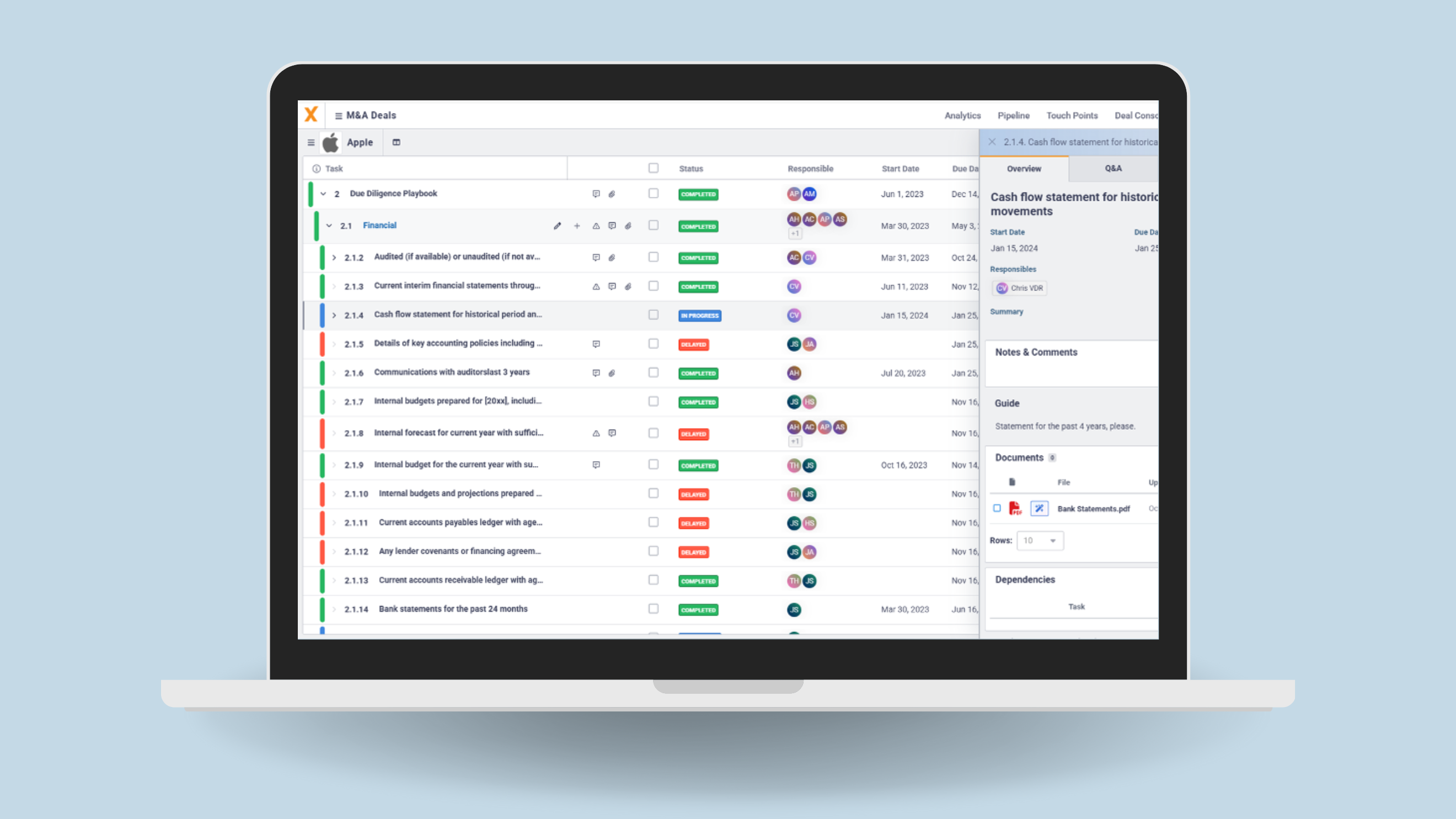

How an M&A Intelligence Platform enables lean M&A teams to deliver large results In today’s competitive deal environment, lean M&A teams are often under the most pressure to deliver — and to deliver fast. They face a Catch-22: while their organizations rely on acquisitions to hit aggressive growth targets, they often lack the resources, systems, and … Read more