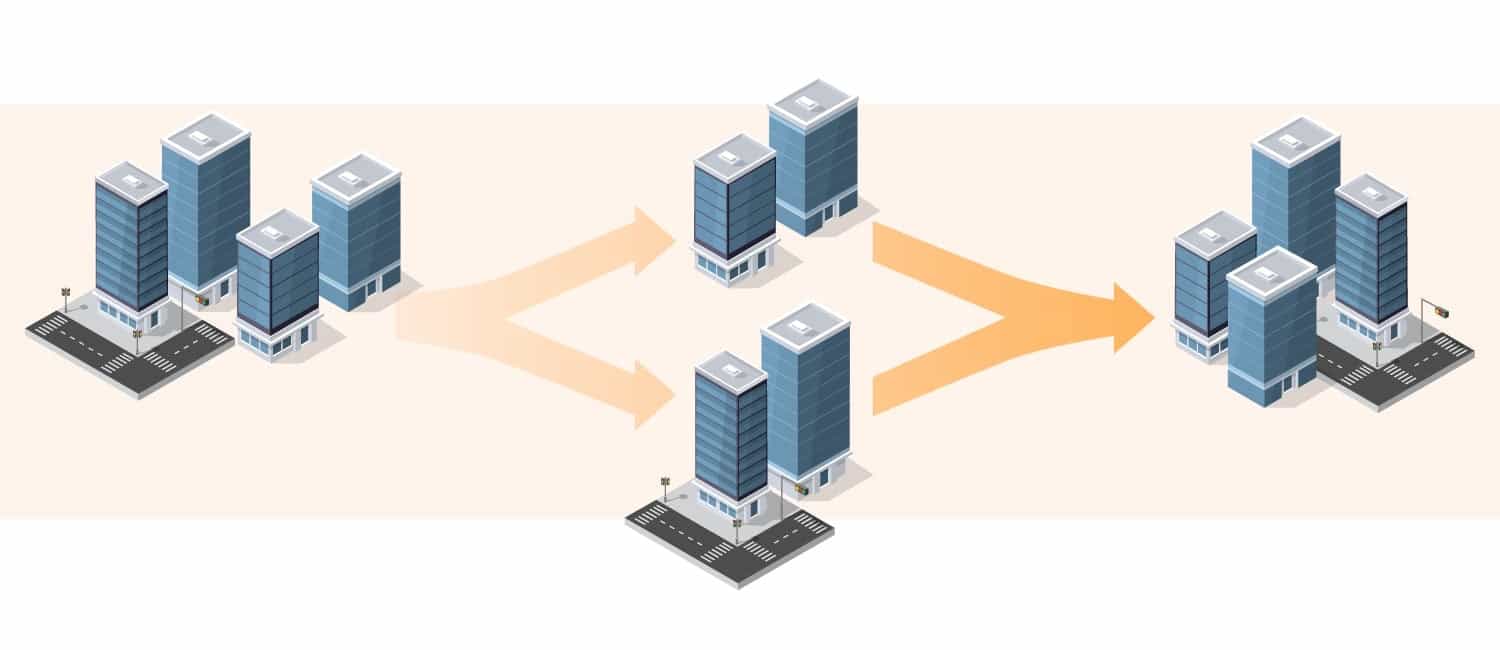

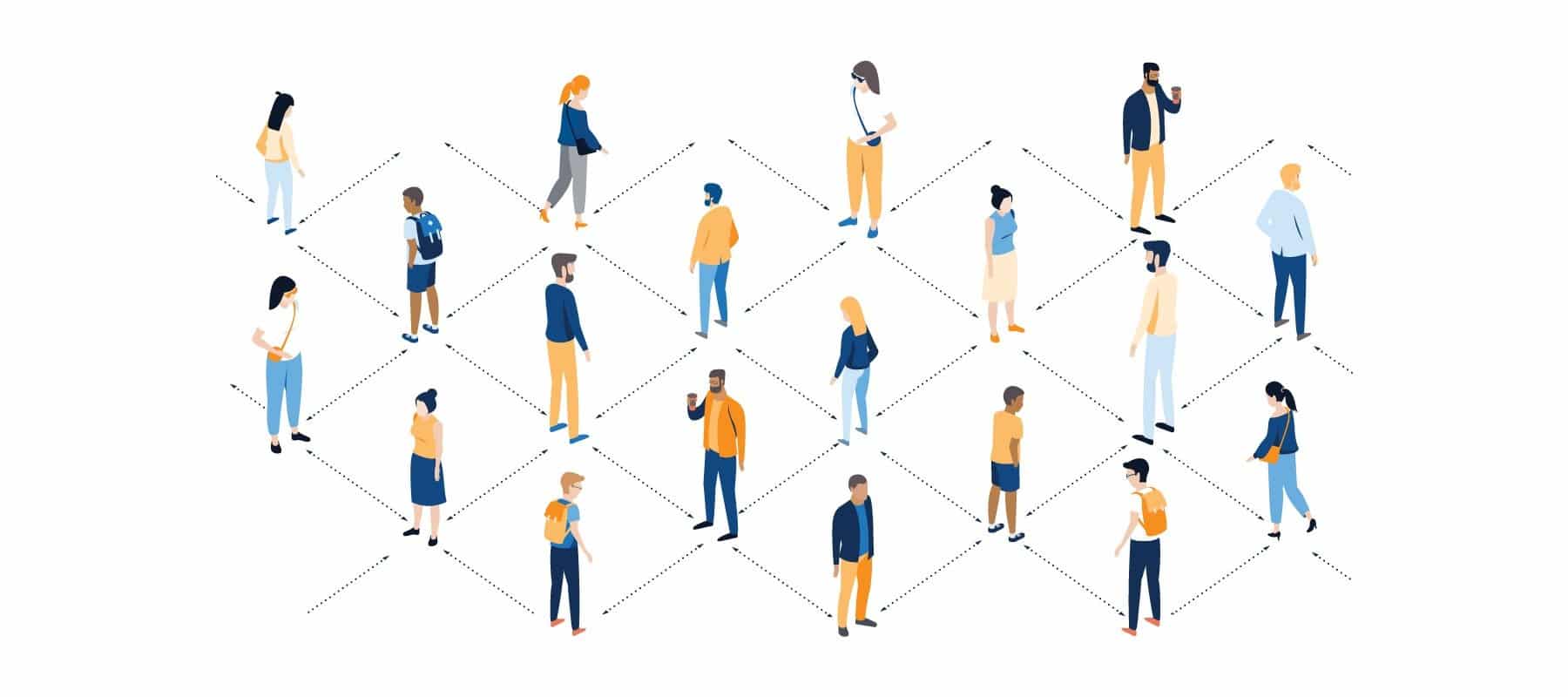

CREO’s Key Factors for Right Sizing Your Post-Merger Integration

Introduction: The risks of not right sizing your integration span from stunted growth to missed opportunity and frustration. For instance, if you oversize your integration with resources and planning, you lose speed and agility; if you go too light, you can overlook critical aspects of culture and synergies. Given the complexity of right sizing integrations, … Read more