Programmatic deal sourcing starts with determining what you want to acquire. That is often easier said than done. Different stakeholders have various urgent strategic priorities, attractive target companies, views about market changes, and other inputs that all make compelling arguments towards going in different directions.

To bring clarity to the M&A Program (and everyone on the same page), an M&A Blueprint needs to be developed. More specifically, this blueprint must explicitly define how M&A will contribute to corporate strategy and guide systematic deal sourcing. Developing an M&A blueprint is an iterative process that analyzes goals for the business, which goals are best achieved through M&A, and what kind of companies to acquire.

Below we outline five key considerations when developing a M&A blueprint for programmatic deal sourcing by using an imaginary company, DentX, as our example.

Key considerations:

- Market trends – how are customer preferences, competitors evolving

- Future state – desired future offering, capabilities, and financial results

- Bottlenecks – things that are difficult, risky, or slow to achieve organically

- M&A feasibility – if/where M&A is the best way to achieve the results

- Ideal target profile – the kind of companies we would like to acquire

The process starts by identifying the key stakeholders to involve. Typically this includes the CEO and business line/unit heads, sometimes product management and senior leadership team members.

1. Market Trends

A recommended order is to start with market trends and desired future state (Offering, Capabilities, and Financial Results), then analyze key bottlenecks for organic growth and conclude with M&A feasibility analysis and formation of an ideal target profile.

Whether you gather these inputs in one-on-one conversations, SurveyMonkey surveys, or strategy workshops, it is important to document the raw answers and opinions, as well as summarize them and socialize the summaries with the key stakeholders at each stage.

Some of this information might also be already gathered on an ongoing basis for general strategic planning or product management. This gives you a kickstart but it is also critical to discuss and also challenge the established assumptions.

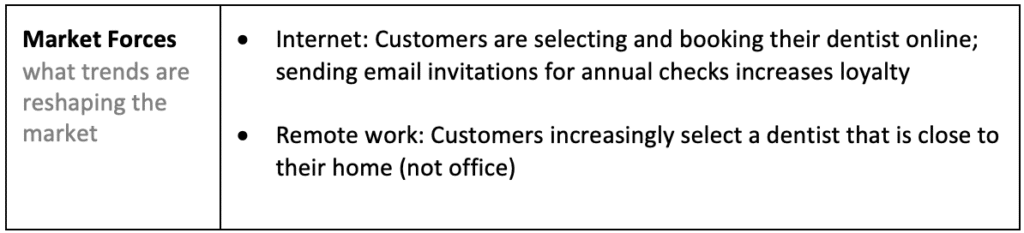

Let’s imagine we are an M&A VP working at a dental clinic chain, “DentX”. After we discussed with the CEO and SVP of Commercial Operations and sent a subsequent survey to regional managers, the primary Market Trends might be summarized like this (simplified):

2. Future State

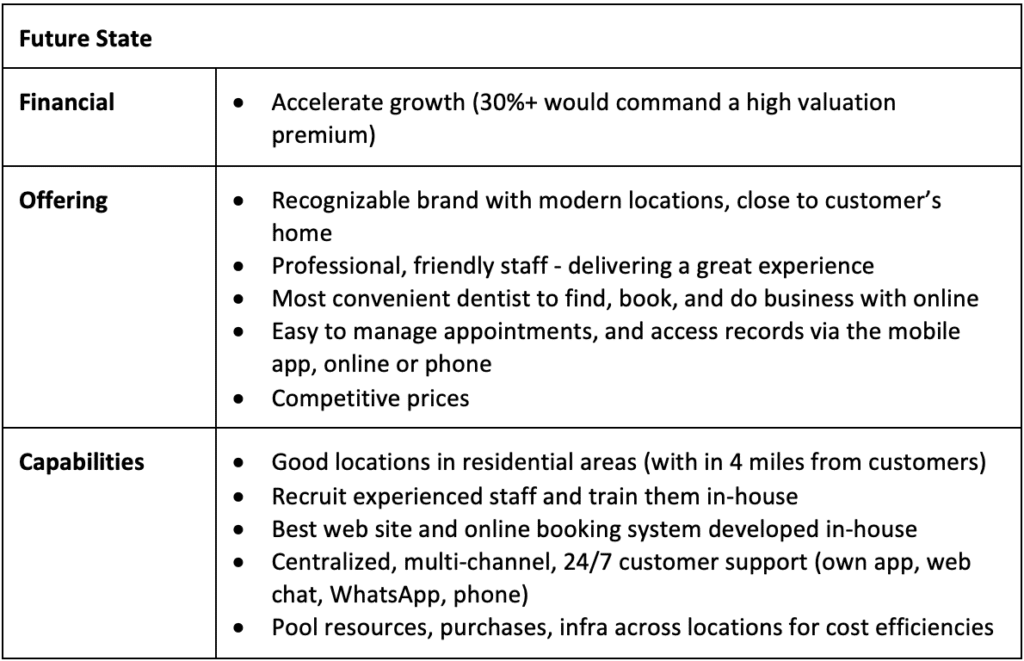

Based on this view on Market Trends, the next step is to collaborate with the key management team to develop an updated view on the Future State of how DentX’s offering should look to the customer and what capabilities are needed to deliver that experience. The CEO also makes it very clear that a key financial goal is to accelerate revenue growth from 12% to 30% because that would command a growth company valuation premium if DentX were to go public through a future IPO.

3. Bottlenecks

If you already have an M&A pipeline full of different acquisition ideas suggested by the stakeholders, it is a good idea to complement the analysis above by looking at the suggested acquisition targets to reverse engineer desired new offerings and capabilities.

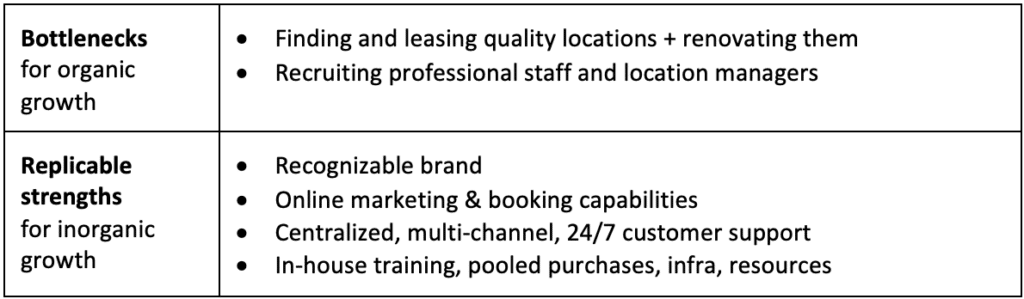

Going back to our example of DentX, a mid-sized chain of 30 clinics with a web-savvy CEO, DentX is already well ahead of most competitors when it comes to web marketing as it has an online reservation system and a 24/7 customer service center. Moreover, there is a solid in-house team focused just on those capabilities. However, what seems to be a real bottleneck for DentX is finding strong locations for new clinics, getting permits and contractors for required renovations, and hiring experienced staff.

From these, we derive our growth Bottlenecks and Replicable strengths.

This analysis points to a legitimate opportunity for value creation through M&A! DentX could acquire small clinics in desired locations and create significant value by rebranding them with DentX’s well-known brand, harnessing DentX’s web marketing engine, adding them to the current online reservation system and pooling resources. Basically, leveraging DentX’s replicable strengths.

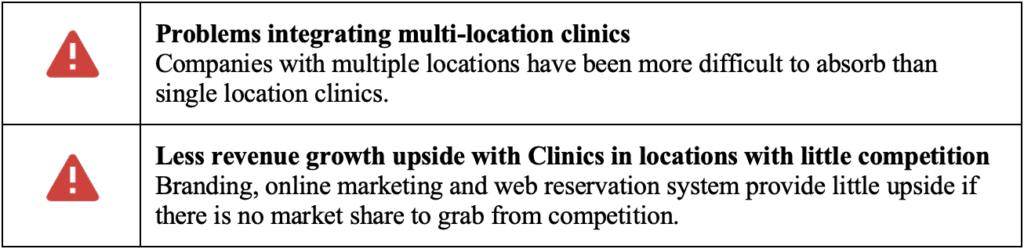

An analysis of likely risks and potential issues acquiring these kinds of smaller clinics should be used to further sharpen the profile of target companies. For example, past M&A deals or common sense could point out that integrating multi-clinic chains would be more difficult than integrating single-location clinics; in addition, clinics that are in areas with multiple competitors (to win market share from) have higher revenue upside than those clinics that are the only game in town.

Example of identified risks/issues when acquiring dental clinics:

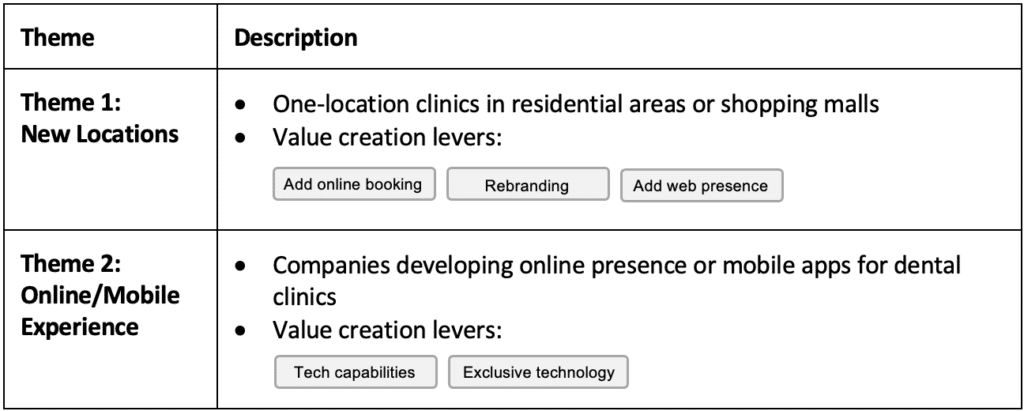

From the analysis above we can derive our primary M&A Themes. These include what capabilities we are acquiring and what kind of companies are best fits to deliver significant value (on a high level):

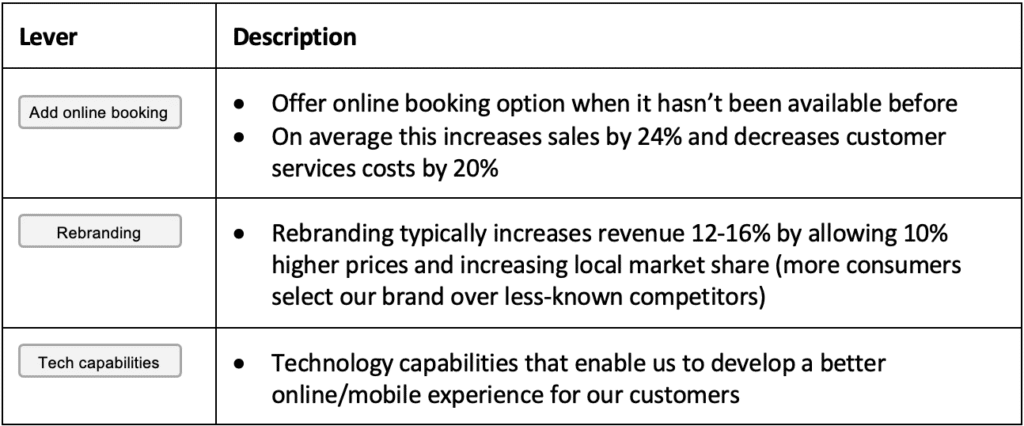

Identifying the key Value Creation Levers allows you to quickly identify value creation opportunities and tag target companies based on applicable levers:

4. M&A Feasibility

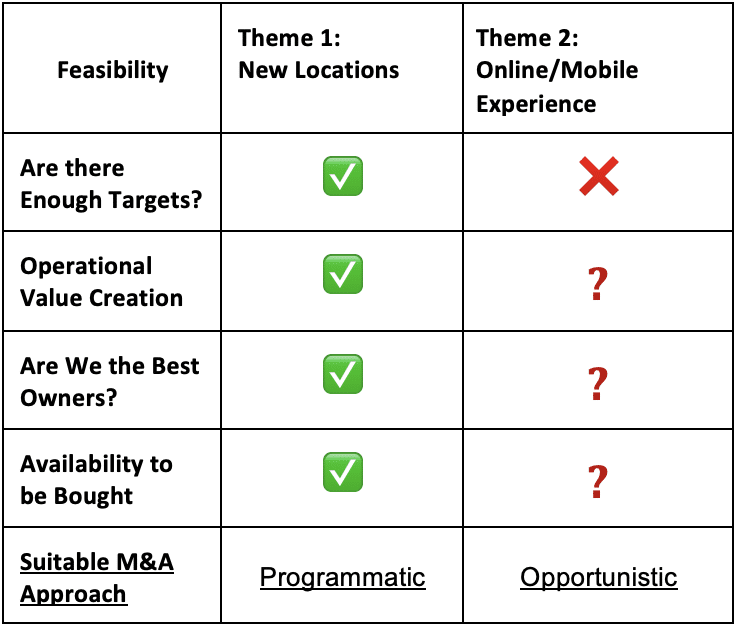

While there may be companies that we would love to be the owners of, that does not mean it makes sense for us to acquire them. In order to truly consider an acquisition there has to be some unrealized value creation potential that is not fully priced in the valuation of the company. This means we need a bottom-up analysis of each theme to determine where M&A is truly a feasible way to accelerate stated strategic goals and create value.

Key considerations for M&A feasibility analysis:

- Are there enough potential, suitable acquisition targets?

- Can we create enough value to be the best owners/acquirers for these companies?

- Are enough companies likely to be available to be bought?

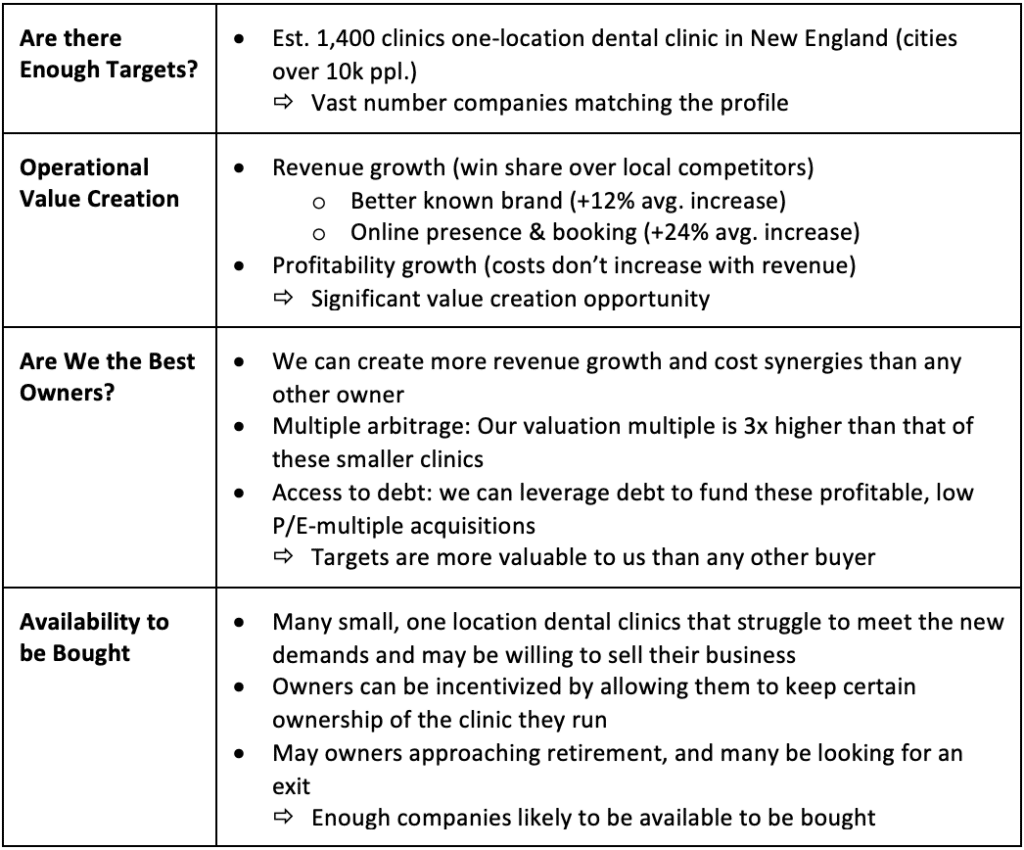

In our example, acquiring new locations works well as an M&A theme because there are plenty of suitable targets available, there are clear operational value creation opportunities, the targets are more valuable to us than what the market values them at, and many of the targets are likely available to be bought. This means we can apply a Programmatic approach to acquire and integrate them through a repetitive motion. Finding this kind of opportunity and scalable model can make M&A a central part of the whole company’s growth strategy.

On the other hand, there aren’t that many companies developing technology to enable dental clinics to offer online services – and those companies are likely more valuable selling the technology to multiple clients – therefore, while we will monitor such players and could do a deal opportunistically, acquiring such companies is not a scalable model to build our M&A strategy around.

Essentially, a Programmatic approach allows a high degree of predictability in terms of financial projections and growth through M&A, while an Opportunistic approach does not.

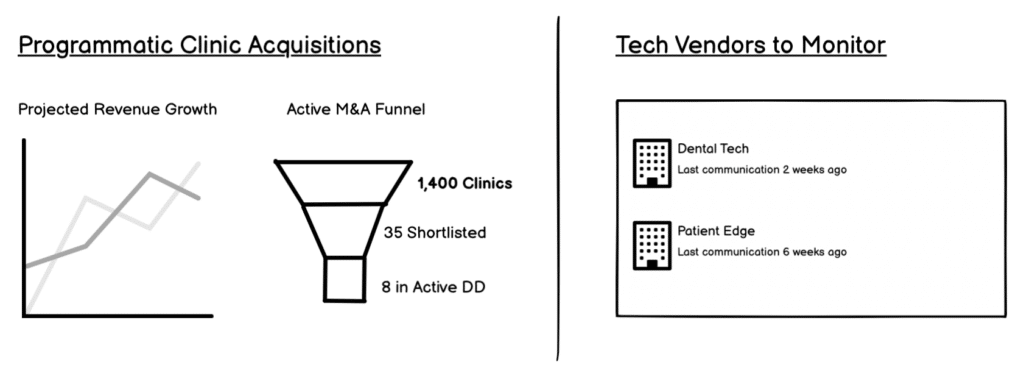

Example dashboard for Programmatic M&A vs Opportunistic deals:

Example of feasibility analysis for theme “New Locations” written out:

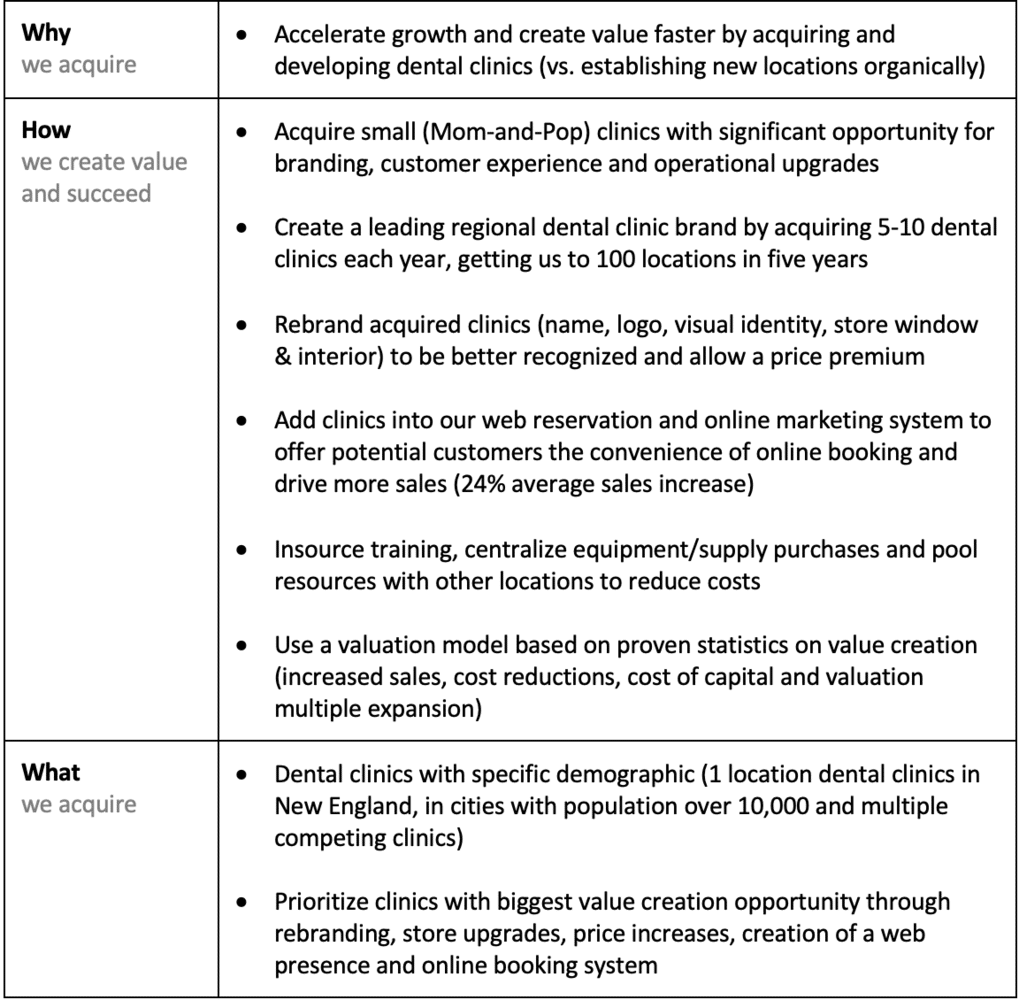

Finally, this enables us to summarize our M&A Program’s high-level purpose (why), ways to create value (how), and what we acquire — as described here.

5. Ideal target profile

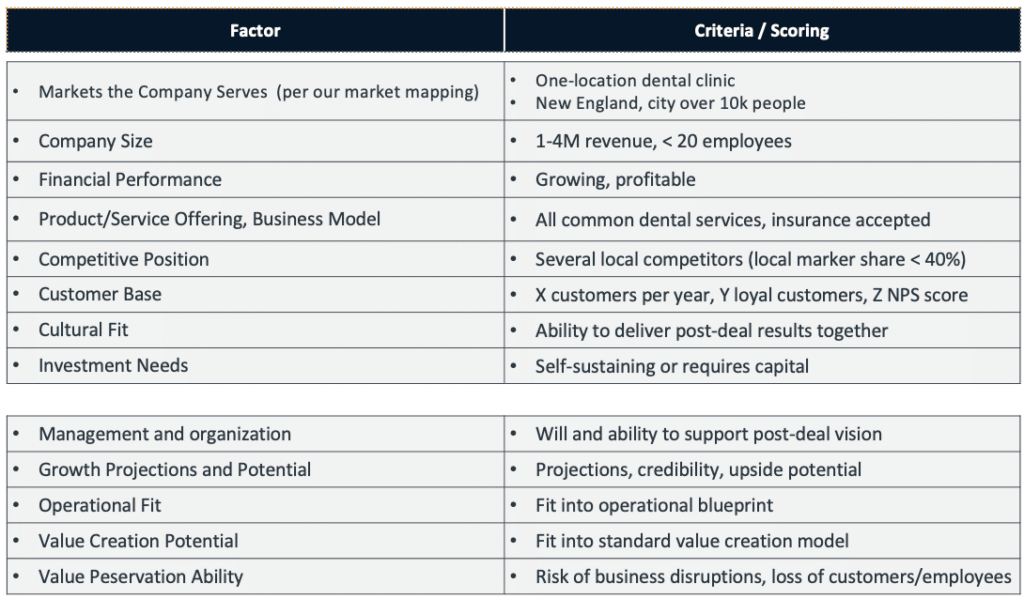

Ideal target profile defines the exact profile of the kind of company we would like to buy. The profile should define the key characteristics that matter the most, as well as a range of acceptable deviance. This profile is used in deal sourcing to find such companies and evaluate potential targets. Having a well-defined ideal target profile allows us to build a target scoring system for objectively evaluating target fit.

Key Takeaways

Programmatic M&A, built around a clear Blueprint, is shown to be the most successful corporate development strategy to build shareholder value.

Having a well-defined M&A Blueprint is vital for programmatic M&A – and for running a successful M&A program in general. It enables you to systematize your approach to deal sourcing, due diligence, and integration in a way that produces the most predictable results possible.