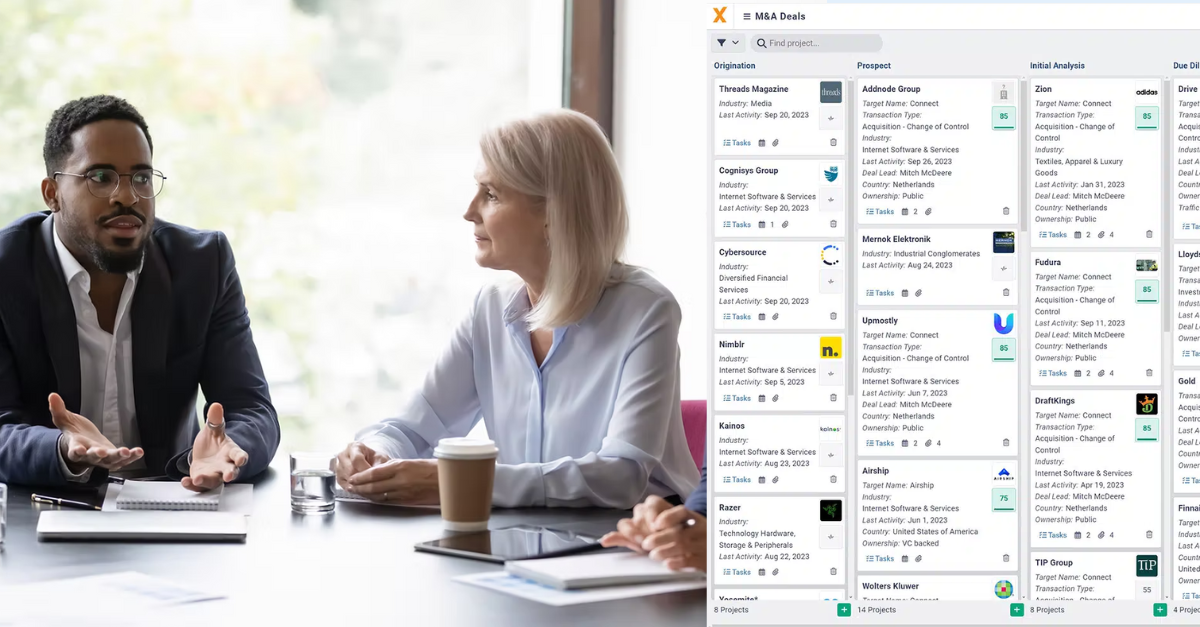

Turning M&A expectations into measurable wins investors will notice

Most CFOs have faced that familiar post-acquisition question: “Are we seeing the return we expected from this deal?” It’s a fair question — and a revealing one. While M&A remains one of the fastest paths to growth, too many deals still underperform against their thesis. To change that, finance leaders are bringing greater discipline, data, … Read more