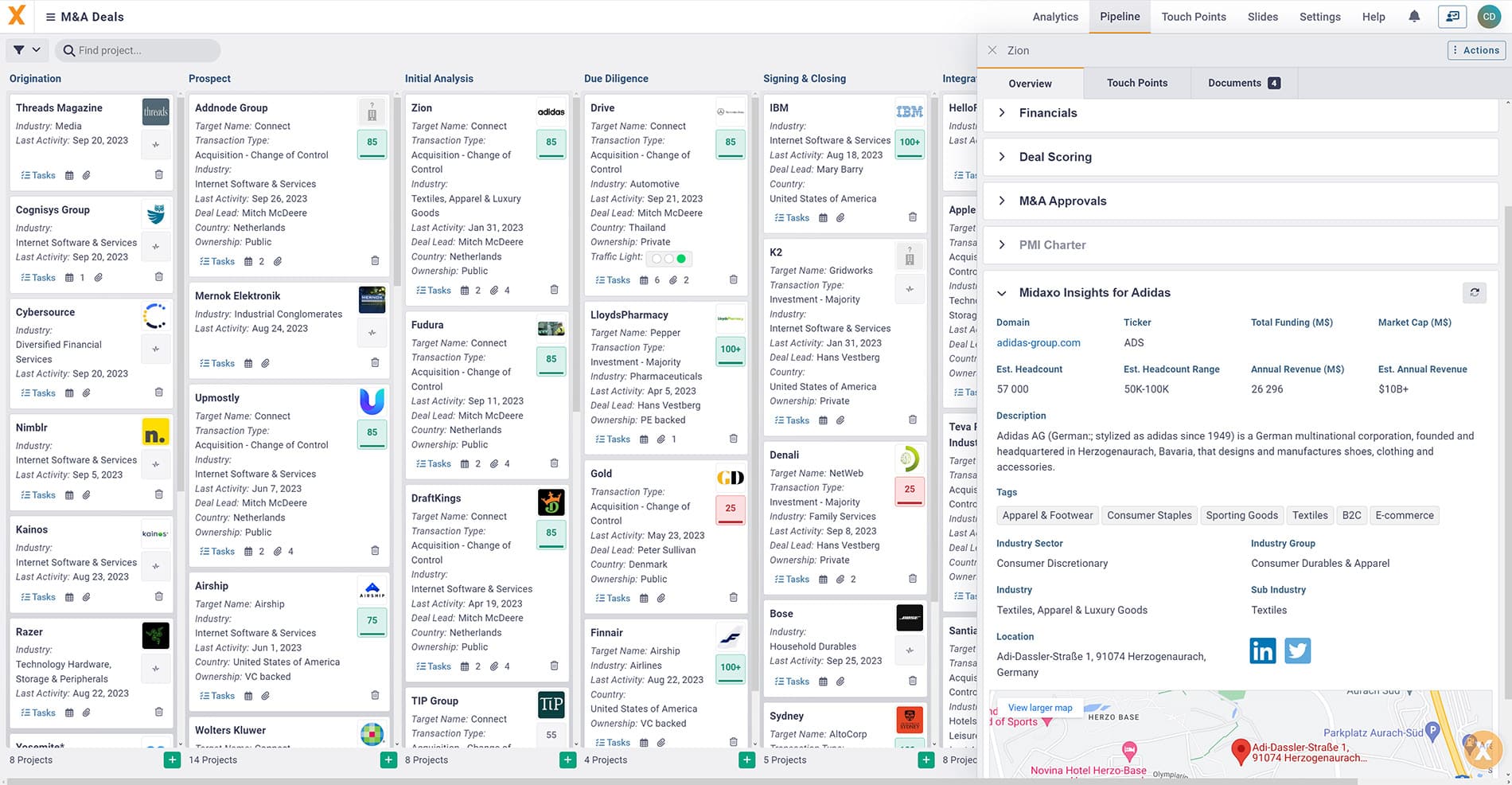

M&A process excellence is the path to success

Why M&A processes are often suboptimal Inorganic growth is a powerful driver of business success. Its influence is only increasing—yet so are the challenges. With the growing reach of Private Equity, a more connected global marketplace, greater access to data and intelligence, and the introduction of emerging technologies like AI, the M&A landscape is more … Read more