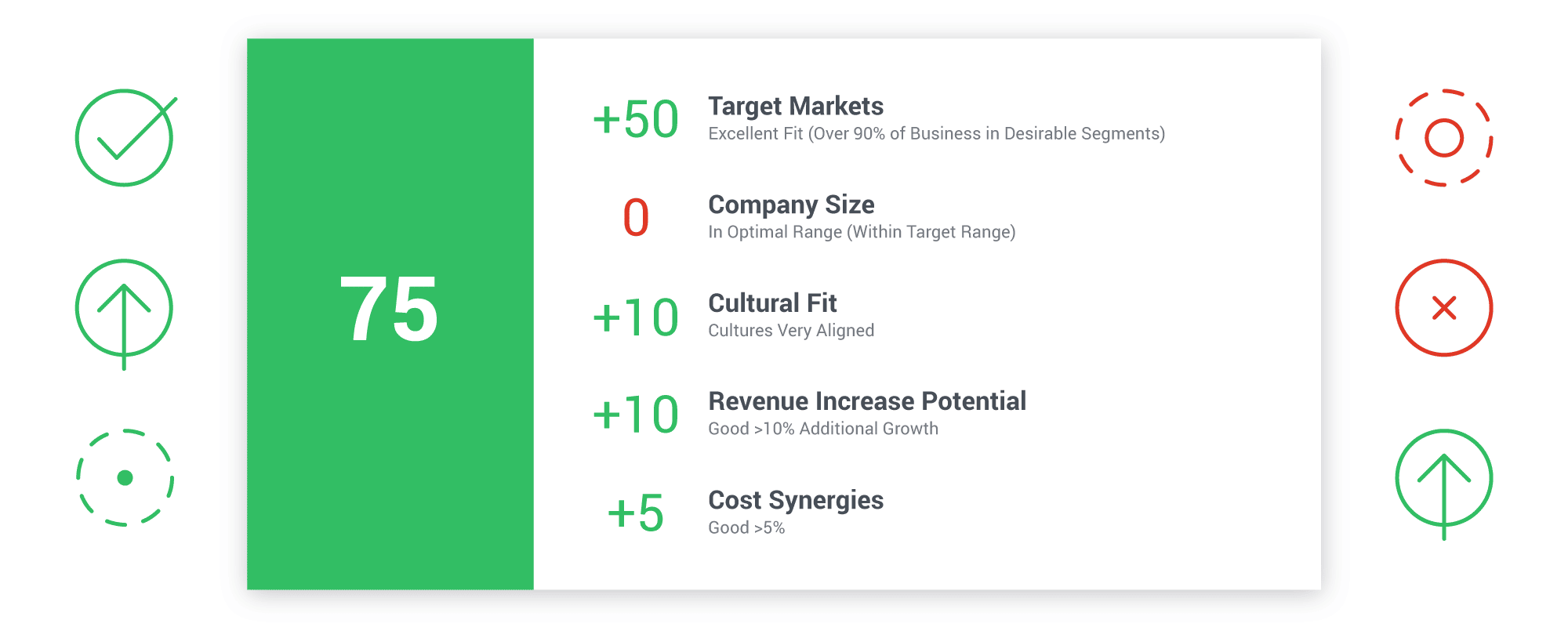

Where legacy meets leadership: how Columbia Forest Products powers growth through purposeful M&A

A legacy of integrity, a future built on values Thoughtful leadership. Sustainability at the core. Exceptional products. Unshakable integrity. A true sense of family. These aren’t just words at Columbia Forest Products—they’re the foundation of how the company operates, innovates, and grows. As the largest manufacturer of hardwood veneer and hardwood plywood in North America, Columbia’s … Read more