The hidden costs of inefficient M&A workflows

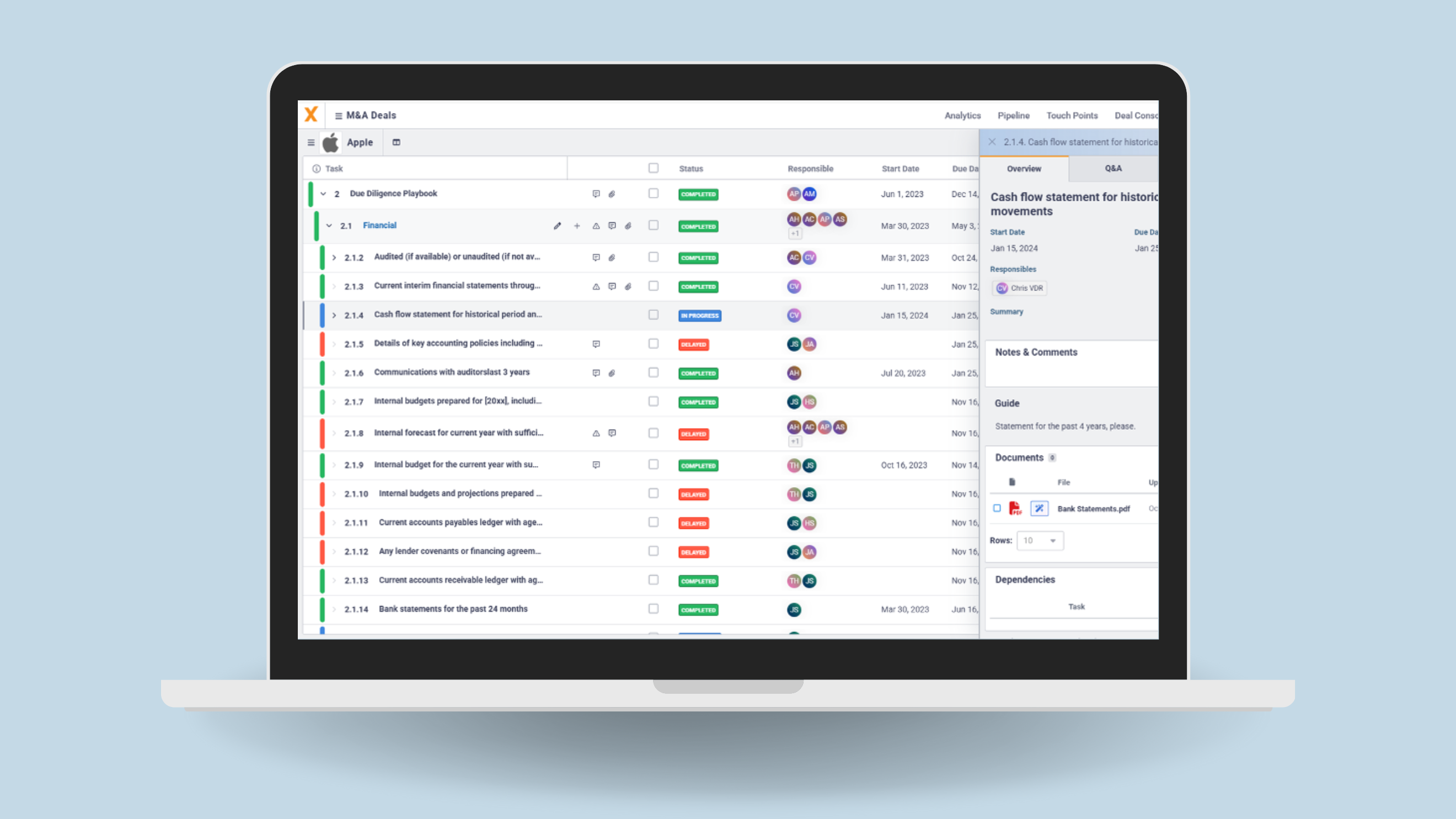

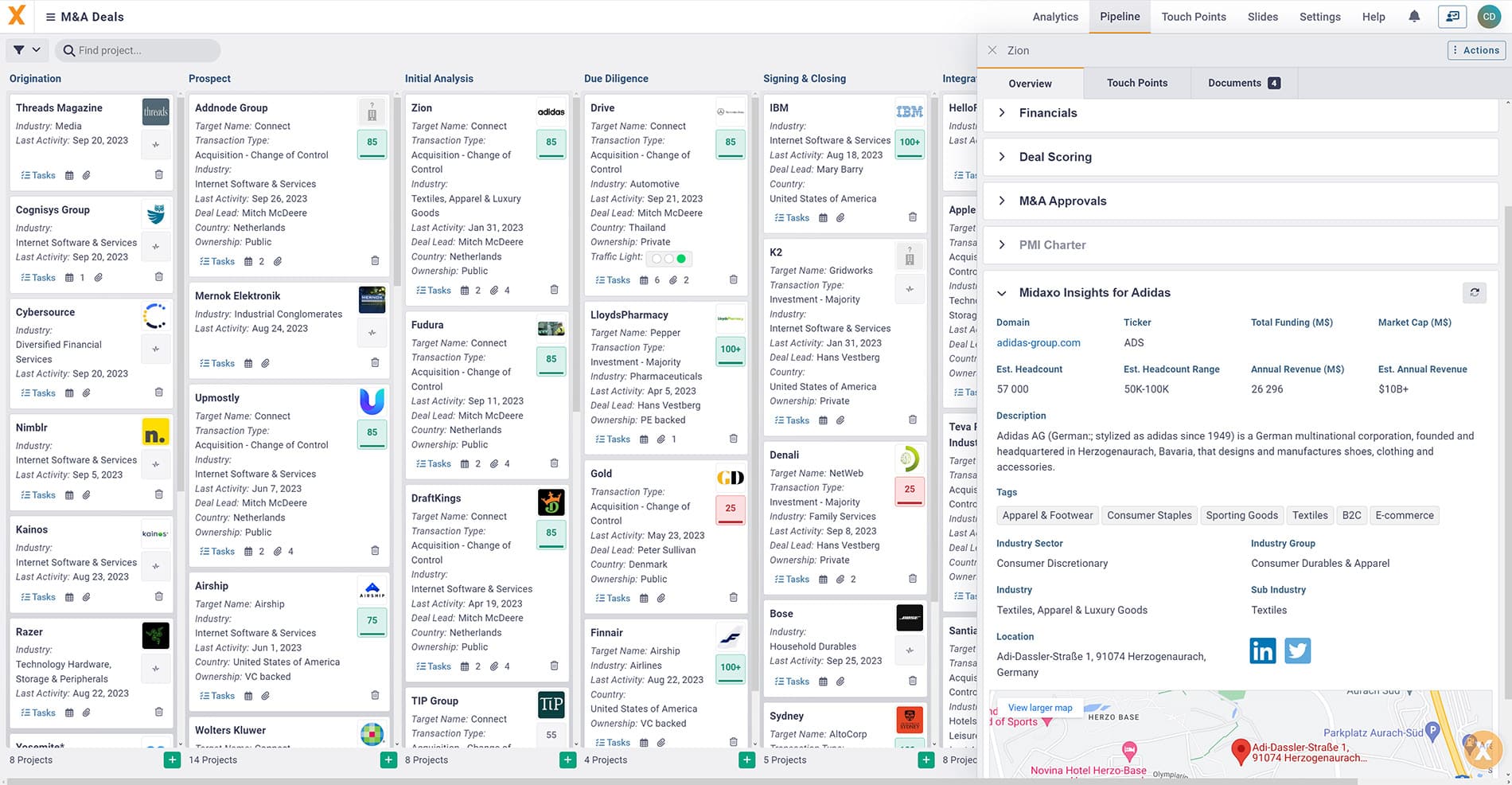

When corporate development teams evaluate the cost of a deal, they often focus on what’s clearly measurable—like advisory fees, legal spend, and integration budgets. But beneath the surface of these transactions lies a set of hidden costs that can quietly erode deal value: the cost of inefficiency. From disconnected tools to chaotic handoffs and lost … Read more