Why Teams Need Living M&A Playbooks: Navigating the Complex Landscape of Corporate Development

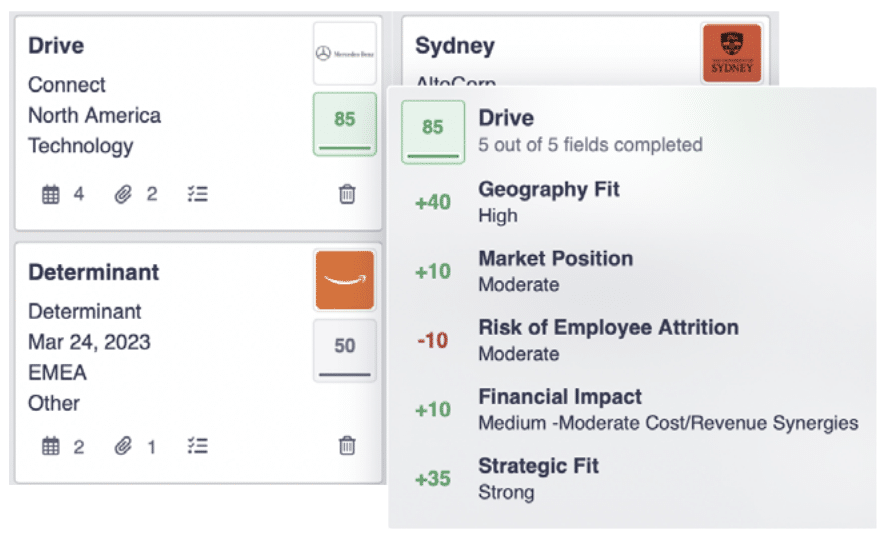

Inorganic growth through M&A and corporate development has become an integral strategy for companies seeking innovation and competitive advantage. However, the journey to successful inorganic growth is often riddled with challenges, uncertainties, and complex decision-making processes. To successfully navigate this intricate landscape, teams must embrace the concept of living playbooks — dynamic, adaptable frameworks saved … Read more