Streamlining Your M&A Pipeline with Midaxo Deal Scoring

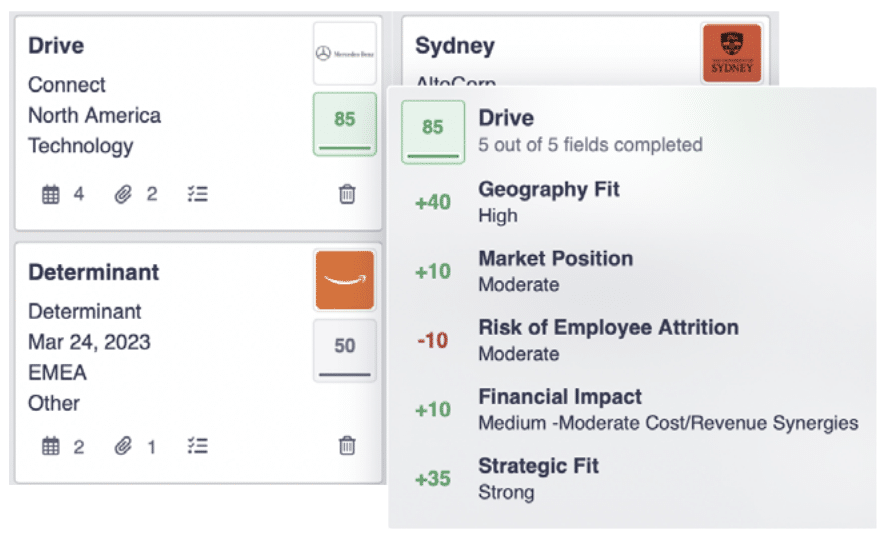

Managing a large pipeline of potential deals can be a daunting task. Deal teams often struggle to prioritize targets effectively and stay focused on the highest value opportunities. However, by leveraging first- and third-party data with Midaxo Deal Scoring, dealmakers can more efficiently focus their pipeline management, prioritize targets based on their deal thesis, and … Read more